Planning for your future is a key part of life – whether it is saving for your children’s education, supplementing your lifestyle or planning your retirement.

However, with interest rates at historic lows, the returns you are getting from savings held on deposit are probably not delivering the long-term returns you need. Over the last number of years, earnings from investments such as equities and bonds have far outstripped that of cash. That’s why we see more investors once again looking at alternatives to holding money on deposit. We know that taking the first step into investment markets can be daunting, so we recommend that you seek professional financial advice from a Financial Advisor or Advisor. To help you with any conversation you might have, over the next few pages, we have outlined some core concepts that you should consider; from being aware of the effect inflation can have on your money, through to the benefits of building a diversified investment portfolio, these are core themes that you should discuss with your Advisor. Saving for the future is essential if you want your goals to be achieved and it is important that you make use of all the options available to you

Cash may not be the answer

As the economy continues to improve many of us will have a little more money to save and spend. While spending is great for the local economy, it’s also important to save for your own future and putting a little aside for a rainy day is second nature for most of us. However, while we are working hard to save, it’s discouraging to see that our savings aren’t working quite so hard for us!

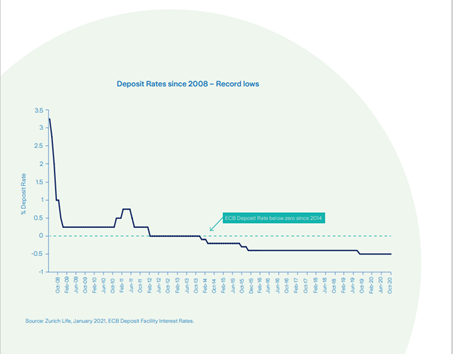

You’ll be only too aware that the returns earned from deposits have been low for some time now. However, when you look at the graph below, it’s surprising to see how low. ECB interest rates have been at record lows since 2009 – that’s over a decade. Warning: Past performance is not a reliable guide to future performance.

Explore the alternatives

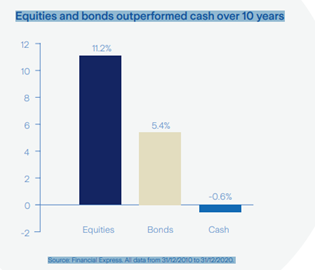

This graph shows how equities and bonds have outperformed cash over the past ten years. It is important to be aware that investing in asset classes, such as equities and bonds, carries the potential for higher returns than cash but it also carries the risk of higher losses to your investment

Diversify, diversify, diversify

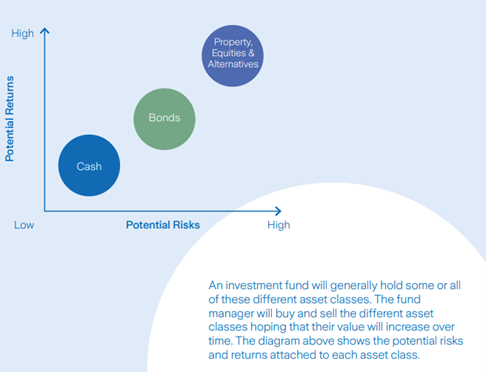

There is an old saying ‘don’t put all your eggs in one basket’, and the same can be said for your investments. However, when we talk about it in terms of your money we call it diversification. Multi-asset funds, which are very popular with Irish investors, allow you to invest in a diversified mix of assets (for example equities, bonds and property) which helps to spread the riskiness of your investment

Generally there are four main types of investment, which we call ‘asset classes’ and a multi-asset investment fund will usually hold some or all of these different asset classes. Each asset class works in a different way and carries its own particular rewards and risks. It is important to understand how they work.

- Cash: money on deposit (e.g. cash in a bank).

- Property: bricks and mortar, or property shares.

- Equities: shares in individual companies.

- Bonds: loans to companies or governments.

- Alternatives: Includes the likes of gold, oil and other ‘non-traditional‘ investments

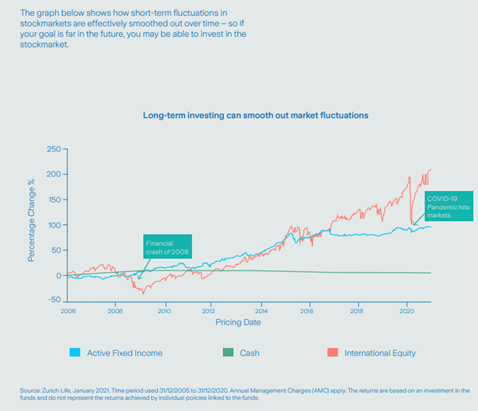

Invest for the long-term

Your savings goals are probably balanced between short-term needs such as saving for a holiday or a new car – and longer term needs such as your retirement or saving for your children’s education. A key determinant of where you should save is how long you can afford to tie up the money.

Find out what type of investor you are

You may have to accept some level of risk when you make an investment but how much depends on what you want to achieve. Only you know what your goals are and how much risk you are prepared to accept to reach them

Deciding what you want to achieve with your investment is important because it will help you make decisions about where to put your money. Usually, your decision will be based on three things

- What do you want to achieve with your money?

- What levels of investment risk are you comfortable with?

- For how long would you be happy to invest your money?

When it comes to your savings and investments, Oaktree are committed to doing the best we can for our customers. So if you’d like to take the next step, get in touch today

Tracy Sumstad is a highly qualified and experienced Senior Financial Consultant with over 20 years of expertise in the Finance Sector. Tracy is well-equipped to provide comprehensive advice on financial planning and corporate solutions. Her focus lies in helping clients identify their unique values and goals, empowering them to make informed financial decisions that protect and enhance their wealth and success.