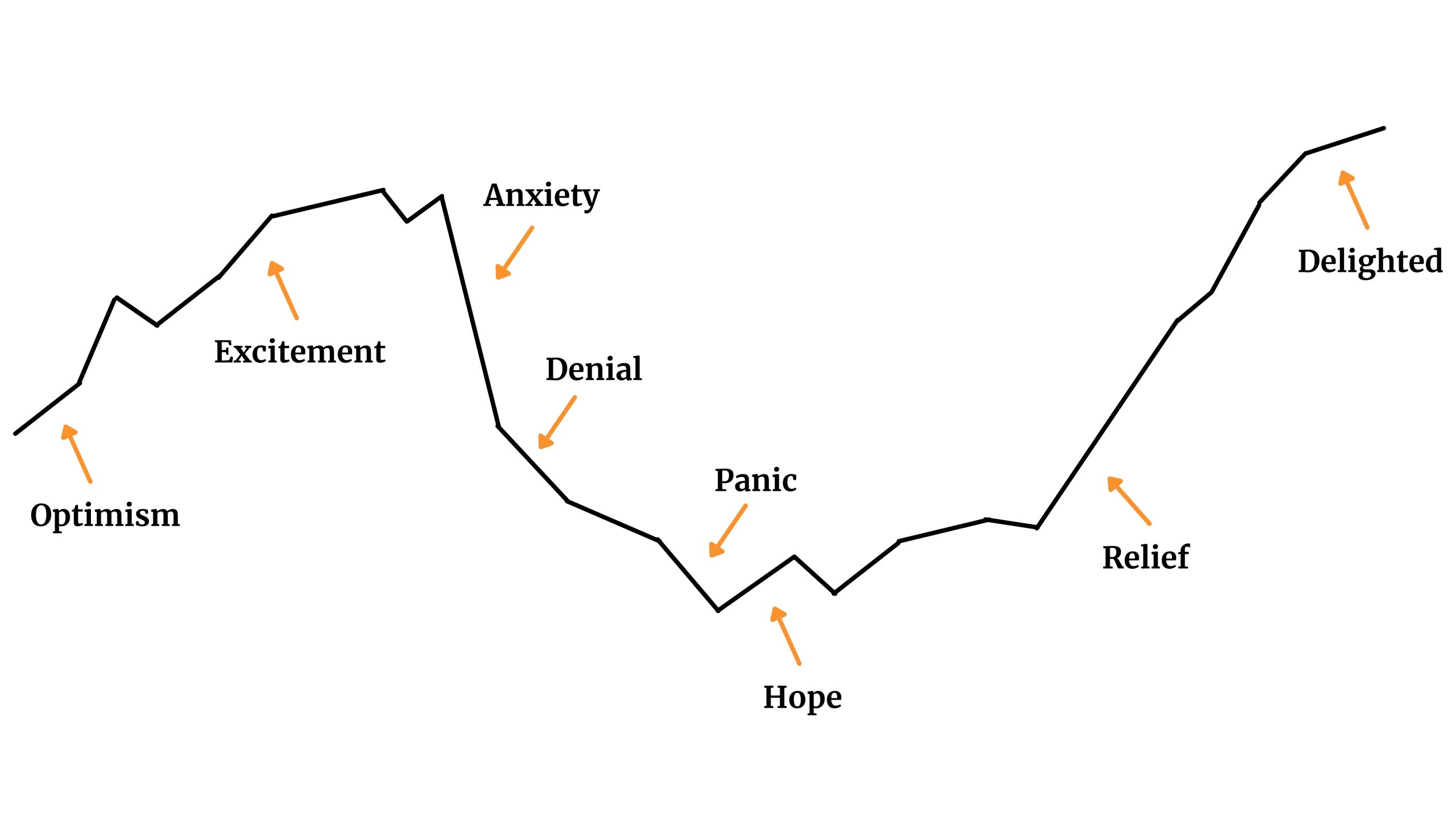

When it comes to money and investing, we are not always as rational as we think we are. Consequently, there is a whole field of study that explains our sometimes ‘strange’ behaviour. During the investment process, investors often experience the ‘roller coaster of emotions’ illustrated below. Does this look or feel familiar to you?

If so, this is perfectly normal. The cyclical investment process is full of psychological experiences. However, by being aware of these behavioural biases, investors can remain impartial and make rational decisions.

Behavioural biases and their impact on investment decisions.

We all have strongly ingrained biases that exist deep within our psyche. Whilst they can serve us well in our day to day lives, they can have the opposite effect with investing. Emotional biases can result in taking actions based on feelings instead of facts. The following is a summary of typical behaviours that impact investment decisions:

- Overconfidence – Most humans tend to view the world positively. However, research has shown that individuals who experience an unrealistic positive self-evaluation can lead to overestimating positive outcomes. Overconfident investors believe they have more control over their investments than they truly do.

- Self-attribution Bias – This occurs when investors attribute a successful outcome to their own actions, and when bad outcomes occur, they attribute this to external factors. This behaviour is often exhibited as a means of self-protection. Investors with self-attribution bias may become overconfident, which can lead to underperformance.

- Loss Aversion – Efficient market theory suggests there is a direct relationship and trade-off between risk and return. The higher the risk associated with an investment, the greater the potential return. The theory assumes that investors seek the highest return for the level of risk they are willing and able to take. This would lead people to be overly cautious and focus on avoiding losses rather than acquiring gains.

- Disposition Effect – As a result of the fear of loss, investors often hesitate to realize their losses and hold stocks for too long hoping for a recovery.

If you’re a personal investor, you can benefit from understanding the driving forces behind investment decisions and the emotional behaviours that will have a direct impact on the outcome. Work with a financial advisor to ensure that you have the perfect investment selection that incorporates all the important factors and considerations for you and your family to hopefully avoid the ‘roller coaster’ journey.

For more information, you can call us on 025-30588 or book a complimentary chat with one of our expert advisors here.

Tracy Sumstad is a highly qualified and experienced Senior Financial Consultant with over 20 years of expertise in the Finance Sector. Tracy is well-equipped to provide comprehensive advice on financial planning and corporate solutions. Her focus lies in helping clients identify their unique values and goals, empowering them to make informed financial decisions that protect and enhance their wealth and success.