- THE STATE PENSION UNCERTAINTY

The number of people aged over 66 is expected to keep growing strongly over the next 35 years. Currently there are nearly 5 adults of working age for every person over 66, this is projected to decline to 2.9 workers by 2035 and further to 2 workers by 2055. This means that there will be more people in retirement and less people at working age to support older generations. This will put the funding of State Pension payments under pressure. Simply put, you cannot be sure the State will provide you with the same level of pension income, medical card support or other benefits as are currently provided.

- ACCESS TO FULL STATE PENSION

The planned increase in the State Pension age to 68 over a number of years has now been removed completely by the government. Instead, the proposal is that people will be allowed to continue to work until the age of 70 from January 2024, thereby deferring taking their benefits from the State Pension and benefiting from a higher pension payment when they retire. Further, over the next ten years, as recommended by the Pensions Commission, we will move to a Total Contributions Approach, ensuring that people’s pension rates are based on the number of years they have worked and paid contributions.

- LIFE EXPECTANCY IS INCREASING

With improvements in health care and lifestyle, people are living much longer and leading more active lives in retirement. While increasing life expectancy is a good thing, it is also something you need to consider when planning for your retirement. Your retirement savings may need to last over 20 years after you finish working.

- INCOME TAX RELIEF

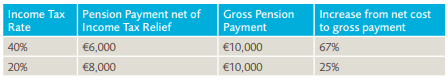

There is significant income tax relief available on payments made personally into pension plans for those that are eligible. This tax relief is available at the higher rate of 40% on pension payments for a top rate tax payer or 20% for a standard rate tax payer. For a higher rate tax payer, this is equivalent to the government topping up their net pension payments by up to 67%!

Pension income in retirement is subject to income tax at your highest rate on withdrawal, USC , PRSI (if applicable) and any other taxes or government levies applicable at that time, however, pension withdrawals can be managed to minimise taxes.. Income Tax relief is not guaranteed.

- TAX FREE RETIREMENT LUMP SUM

Tax free retirement lump sums are available when taking retirement benefits. Those who are about to retire can take 25% of their pension fund as a retirement lump sum or with a company pension they can instead choose to take a retirement lump sum of up to one-and-a half times their final salary, depending on the length of time employed. The maximum total tax-free amount is €200,000. A retirement lump sum of between €200,000 and €500,000 is subject to standard-rate income tax, currently 20%. Someone who can take a retirement lump sum allowance of €350,000 would pay tax of €30,000 and receive €320,000 in their hand.

- PENSION LIFE INSURANCE

The same income tax relief that applies on pension payments is also available for Pension Life Insurance, which means cheaper life cover. For example, a 40 year old self-employed non-smoker taking out €200,000 of life cover to age 65 with indexation and conversion option could choose between a term life insurance plan and personal pension life insurance.

| Cover Required | Gross Cost (incl Govt Levy) | Net Cost after income tax relief at 40% | Net Cost after income tax relief at 20% | |

| Term Life Insurance | €200,000 | €24.30 | €24.30 | €24.30 |

| Pension Life Insurance | €200,000 | €24.48 | €14.69 | €19.59 |

The tax treatment of a lump sum paid out on death is the same for term life insurance and pension life insurance. In each case the lump sum is subject to inheritance tax, and there is no tax if the lump sum is going to a spouse or registered civil partner.

- APPROVED RETIREMENT FUND (ARF) OPTIONS FOR ALL

The ARF options are available to

- Members and directors in Defined Contribution (DC) Company Pensions

- Additional Voluntary Contributions (AVCs) for those in Defined Benefit (DB) Company Pensions

- Buy out Bonds from DC and DB schemes

- Personal Pensions

- Personal Retirement Savings Plan (PRSAs)

Individuals need to consider their options carefully on retirement, and will need advice more than ever in this area. However, the ARF option gives what many individuals want in terms of control over income drawdown and control over investment options.

- INHERITANCE PLANNING

There are a number of inheritance tax planning advantages both pre and post retirement which ensure that the assets you have built up can transfer tax efficiently to your spouse, children or estate in general. There are a number of different permutations and so I do not intend to cover these in this article.

- GROSS ROLL UP

Exit Tax on savings and investment plans is 41%. DIRT (Deposit Interest Retention Tax) is 33%. Capital Gains Tax is 33%, with an annual exemption of €1,270. Pension funds are exempt from Irish income and capital gains taxes (however pension income in retirement is subject to income tax at your highest rate on withdrawal, USC (Universal Social Charge), PRSI (Pay Related Social Insurance) (if applicable) and any other taxes or government levies applicable at that time).

- INVESTMENT OPTIONS TO SUIT EVERY INVESTOR TYPE

Pensions allow for a wide range of investment options to suit every risk appetite. This includes investments in shares, property, bonds, cash and externally managed funds. Different currencies such as Euro, Sterling or Dollar are also available.

Contact Oaktree Financial Services today to discuss the options and get advice on the pension product and funds suitable for your own specific circumstances.

Adrian Godwin is a Senior Financial Consultant and the co-founder and managing director of Oaktree Financial Services. With a background in accounting and tax advising, Adrian specialises in estate planning and wealth management.Adrian offers clients reassurance through best practice solutions. His unique skill set and qualifications enable clients to develop comprehensive life plans that align with their goals.