The transfer value ordinarily paid from pension schemes is typically poor value for members unless they are close to retirement. An Enhanced Transfer Value (ETV) exercise offers members a once-off opportunity to transfer the value of the pension, on enhanced terms, to another pension arrangement while also offering the company and trustees an opportunity to de-risk the pension scheme.

There are many things to consider when you receive an Enhanced Transfer Value of your pension. The main question of course is should you take an Enhanced Transfer Value Pension.

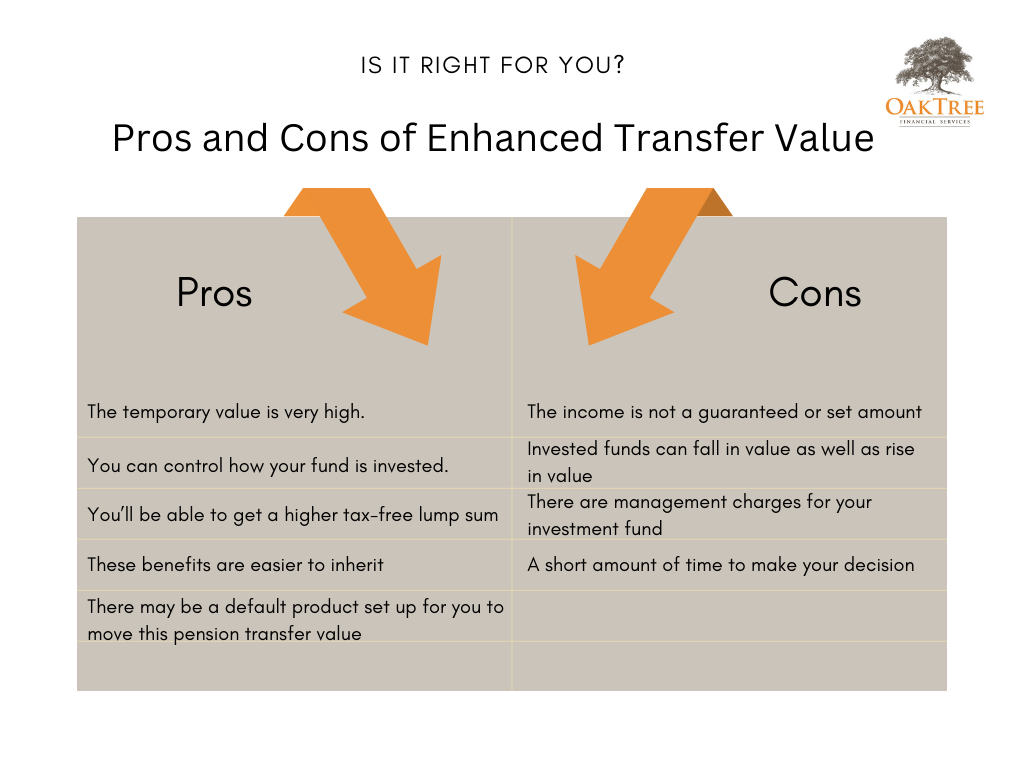

In order to make an informed decision, you need to be aware of the benefits and drawbacks of this pension transfer values process, especially, since your employer generally won’t give you a long period of time to decide. Therefore, you will have to make a decision quickly.

Why is my old employer offering this?

Employers often use Enhanced Transfer Values to reduce the liabilities and costs of the scheme. Also, they use them to preserve the fund long-term for people who currently work for the company.

Example of Defined Benefit Pension Transfer value Scheme

:

Ruth is 52 and used to work for a company with a Defined Benefit Pension Transfer value Scheme. She has been contacted about an Enhanced Transfer Value if she were to move her fund. Usually, the pension transfer value her former employer would offer is €280,000, but for a short time, they are offering her €400,000.

If Ruth Stays In The Scheme

1. She’ll receive €10,000 per year when she retires.

2. This is an annuity, where the income is guaranteed for life. It stops when she dies.

3. The scheme will allow 50% of the annuity or €5,000 per year to be inherited by a surviving spouse.

If Ruth Leaves The Scheme

1. She takes her €400,000 fund and moves it to a Personal Retirement Bond.

2. The €400,000 is invested. Ruth can take her retirement benefits at 66 when she leaves her job.

3. She can take 25% of this fund tax-free.

4. With her remaining 75%, she can then buy her own annuity or invest in an Approved Retirement Fund.

What does Ruth decide to do, and why?

• Ruth decides to take the offer. She has a pension scheme in her current job, so she feels that she understands the risk of investing. Moreover, she knows that the fund may fall as well as rise.

• While the former employer’s pension gives her a guaranteed income in retirement, she isn’t married, so she doesn’t need to be able to leave 50% of her annuity to a partner.

• She would like to be able to use the higher 25% tax-free lump sum for home repairs.

• She wants to be able to leave inheritable funds in her estate. In addition, Ruth has one daughter, and her home is valued at €500,000, which is over the €335,000 inheritance threshold. When Ruth dies, she wants there to be some cash in her estate for inheritance tax purposes.

How can we help with defined pension transfer values?

The most important thing to do is make sure that you seek advice quickly. Figuring out if the offer will benefit you can be complicated, and it’s important to be very clear about the offer & your options.

We work with many clients through all stages of an ETV offer and focus on the financial impact of the acceptance or non acceptance of the offer. Book a chat with one of our advisors today or call 025-30588

Adrian Godwin is a Senior Financial Consultant and the co-founder and managing director of Oaktree Financial Services. With a background in accounting and tax advising, Adrian specialises in estate planning and wealth management.Adrian offers clients reassurance through best practice solutions. His unique skill set and qualifications enable clients to develop comprehensive life plans that align with their goals.