If you have established a successful company that is profitable, then the company should serve you, and in order to do this, you need to be able to extract wealth from the company in the most tax-effective manner possible.

As a company director, you have substantial scope to use pension legislation as a tool for extracting wealth from your company, so you can benefit from advice on the more technical aspects of pension law and investment management. We encourage our clients to look at pensions as a tool for tax-effective wealth extraction. Few business owners use the legislation to maximum effect. Most have scope to do additional tax planning.

One of the most attractive and tax-efficient ways for company directors to extract profits from their company and turn them into personal wealth is to have their company make contributions to an Executive Pension Plan.

What is an Executive Pension?

An Executive Pension is a pension set up by the Ltd company for the benefit of the Directors/Senior Employees of the company. The pension is set up under a trust and typically the employer will act as the trustee.

Similar to a Defined Contribution Scheme, with an Executive Pension both employees and employers can make contributions. The ultimate value of your pension plan will depend on the contributions that have been made over the years and the investment return the funds have achieved in your Executive Pension.

What is the benefit of an Executive Pension over a Personal Pension?

The limits on contributions to an Executive Pension are significantly greater than a Personal Pension. For example, a 40-year-old male can contribute up to 108% of his salary and a 40-year-old female can contribute up to 100%. While under a Personal Pension, both can only contribute up to 25%. This contribution amount grows significantly up to over 400% if you are over 50. When you are the owner of the business, this can be utilised as a tax-efficient method of taking cash from the business.

The tax relief is also more attractive. The maximum rate of relief on a Personal Pension contribution is 40%. If you contribute to an Executive Pension, it is effectively saving you tax at 52%. You can also claim the benefit of your Executive Pension from the age of 50 Vs age 60 in a Personal Pension.

How do I make contributions to the Executive Pension Plan?

Contributions are made through the company’s bank account monthly and you can also make lump-sum payments e.g. before your company year-end.

Can you show me an example of how I save money by contributing to a pension?

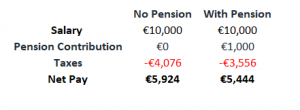

As per the example below, by investing €1,000 into their pension, this person saved €520 in tax and only had a ‘net’ contribution of €480.

How much can I contribute to my pension through my Limited company?

It depends on several factors. Ultimately, as an individual making personal contributions, you are limited to the normal revenue rules which relate to age and appropriate % of salary e.g. if you are in your 40s, it is 25% of your salary. When it comes to the company making the contribution on your behalf, as is the case with an Executive Pension, then there are a range of factors in determining how much can be contributed. These include;

- Age

- Gender

- Marital Status

- Chosen Retirement Age

- Salary

- Previous Pensions

- Years of Service With Current Employer

Can I set up a pension for my spouse through the limited company?

Absolutely! You can set up a pension for anyone employed by the company who is drawing a salary. In some cases, it can prove to be an extremely tax-efficient method of pension funding.

I have finished my contract, what are my options now?

You have 4 options:

1: Retaining your benefits with the scheme – this means the funds will remain invested and you can claim at any age from 50.

2: Transferring your benefits to a new employer’s Occupational Pension Scheme – you can opt to transfer the value of your fund into your new employer’s pension scheme (if applicable).

3: Transfer benefits to a Personal Retirement Bond – A Personal Retirement Bond (PRB), which is also sometimes known as a Buy-Out-Bond, is used by the trustees of a pension scheme to buy retirement benefits for former members of their pension scheme. A PRB is a personal policy in the name of the PRB holder. When a member leaves a pension scheme, the value of their fund when they leave the pension scheme is invested in the bond. When they retire, they can then use the proceeds of the PRB to provide retirement benefits.

4: Depending on your circumstances you may be entitled to transfer to a PRSA – This option is restricted to those with under 15 years of pensionable service with the employer. If the value of your pension is greater than €10,000 you will be required to pay for a Certificate of Comparison showing the pros and cons of a transfer to a PRSA. A Certificate of Comparison can typically cost anything between €500 and €2,000 depending on the circumstances. A Certificate of Comparison is not required if the pension scheme is winding up.

At what stage can I draw down my pension?

You are eligible to claim the benefits of your Executive Pension from the age of 50. To do this, you must no longer be an employee of the company. So, for example, you can fund your pension today, take up a new role and subsequently begin to draw on your pension benefits from the age of 50 even though you are still working. The obvious caveat here is that you should only ever draw on your pension when you absolutely need to as to do so will simply reduce the value of your future benefit when the time comes that you don’t have any other source of income.

For more information, give us a call on 025-30588 or book a complimentary chat here. We are always happy to help.

Adrian Godwin is a Senior Financial Consultant and the co-founder and managing director of Oaktree Financial Services. With a background in accounting and tax advising, Adrian specialises in estate planning and wealth management.Adrian offers clients reassurance through best practice solutions. His unique skill set and qualifications enable clients to develop comprehensive life plans that align with their goals.