Think you don’t need to consider a pension at 30?

Think Again!

The Early Bird…

There are choices you make in life that will have a huge impact on your future. Starting a pension for your retirement (yes it’s a long way away) is one of those choices because the earlier you start the brighter your future.

It doesn’t cost as much as you think

Tax relief is by far the greatest advantage of saving in a pension. If you’re paying tax on your salary at the highest rate, then you’re entitled to get a 40% saving on any pension contributions you make.

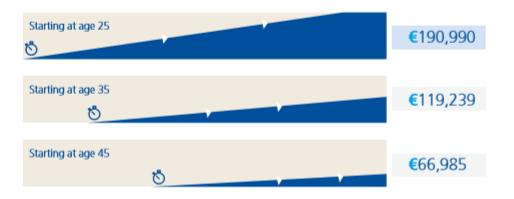

So a €120 contribution a month from you, along with the €80 from the taxman could grow to over €190,000* at age 65 for a 25-year-old.

Starting early is the best thing you can do for your pension

Over a 40 year period, a 25-year-old will generate a 60% greater return than the person starting 10 years later.

Over the same period, that 25-year-old generates a 180% greater return than the person who waits until they are 45.

We are proud of our track record in managing customers’ investments. Below is an example of a client’s pension investment performance with Zurich.

Source: Zurich and MoneyMate, January 2020. Performance figures quoted are for 01/11/1989 – 01/01/2020. Annual management fees apply; the fund growth shown above is gross of any annual management charge. Returns are based on offer to offer performance and do not represent the return achieved by individual policies linked to the fund. *Source: Brokers Ireland Financial Excellence Survey, November 2019.

For more information please contact us to discuss and guide you through how you can secure a comfortable retirement income.

Tracy Sumstad is a highly qualified and experienced Senior Financial Consultant with over 20 years of expertise in the Finance Sector. Tracy is well-equipped to provide comprehensive advice on financial planning and corporate solutions. Her focus lies in helping clients identify their unique values and goals, empowering them to make informed financial decisions that protect and enhance their wealth and success.