As people progress through their life a time will come when retirement will be on the doorstep.

For some people, the State pension is enough to provide a basic level of income. Others may have an opportunity to accumulate wealth without using pension schemes – perhaps through their business ventures or other assets. But most people will want to supplement their state pension with some form of pension scheme.

Many employers also take the view that, while their employees are working, they should be building up an entitlement to a pension when they retire.

Retirement

When people come to retire they will experience a reduction in income – a pension makes up for some of this loss of income in retirement. Therefore, it’s important to take control of your retirement planning and make decisions regarding your pension.

Sadly, it is not appreciated that contributing to a pension plan can help build an extremely valuable asset. The State Pension is intended to ensure that everyone received a basic standard of living in retirement. E.g. Full State Pension (Contributory) current is €248.30 per week or €12,912 per annum.

You need to decide if this is enough to live on in retirement, and if not, where will your additional retirement income come from. Few people realise that providing the required level of income requires a substantial level of pension savings.

Example

If you were to buy a pension from an insurance company at retirement of €10,000 per annum, you would need a pension fund of approximately €200,000. To avoid having to put aside large amounts, it is better to join a pension scheme and start saving as soon as you can.

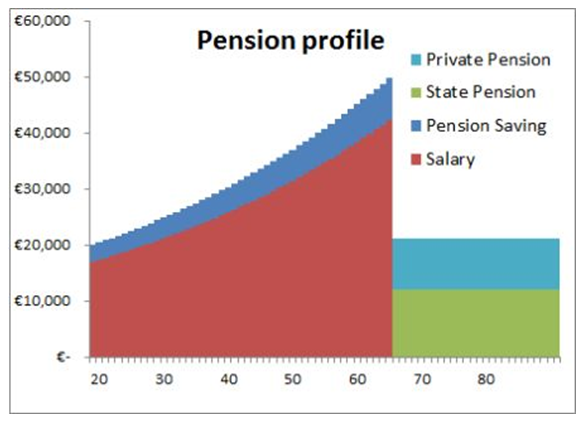

A typical pension profile is illustrated below. This shows that pension savings are required while salary is being earned, to provide a private pension in retirement to supplement the amount available from the state.

In order to plan for retirement, you will need to consider where your income will come from in retirement and what level of income you will need.

Particular Issues for Women

Although men and women are treated equally in relation to pension provision, there are a number of areas such a maternity leave, part-time working, and breaks in employment that are of particular interest to women.

Some women are homemakers and rely on benefits available from their spouse/partner’s pension scheme. Also, women generally live longer than men and are therefore more likely to need their pension to last longer. These factors mean that women can be more vulnerable in relation to retirement.

Pension Options

Potentially your income could come from the State Pension, your Occupational Pension Scheme if you are in such a scheme, a personal pension or a Personal Retirement Saving Account if you have one, and any other non-pension based sources of income you may have.

Your options will depend on your work situation. If you are an employee you may be able to join a pension scheme sponsored by your employer. Employees in the public sector can join their public sector pension scheme. The self-employed can take out a personal pension.

Personal Retirement Savings Accounts are open to virtually anyone – employed or self-employed or those currently working – to save for retirement.

The best option for you will depend on your personal circumstances and work situation. If you have not already done so, you should seek advice from a trusted advisor to identify what would be the most relevant to you and personalise your Retirement Plan to suit your individual circumstances.

Adrian Godwin is a Senior Financial Consultant and the co-founder and managing director of Oaktree Financial Services. With a background in accounting and tax advising, Adrian specialises in estate planning and wealth management.Adrian offers clients reassurance through best practice solutions. His unique skill set and qualifications enable clients to develop comprehensive life plans that align with their goals.