When it comes to financing their children through college, nearly half of parents use savings to pay for their children’s college education. 70% of parents find covering the cost of this level of education a financial burden. While the figures for parents getting into debt for primary and secondary school are much lower, when it comes to funding university students, 41% of parents find that they do get into some level of debt to cover the costs.

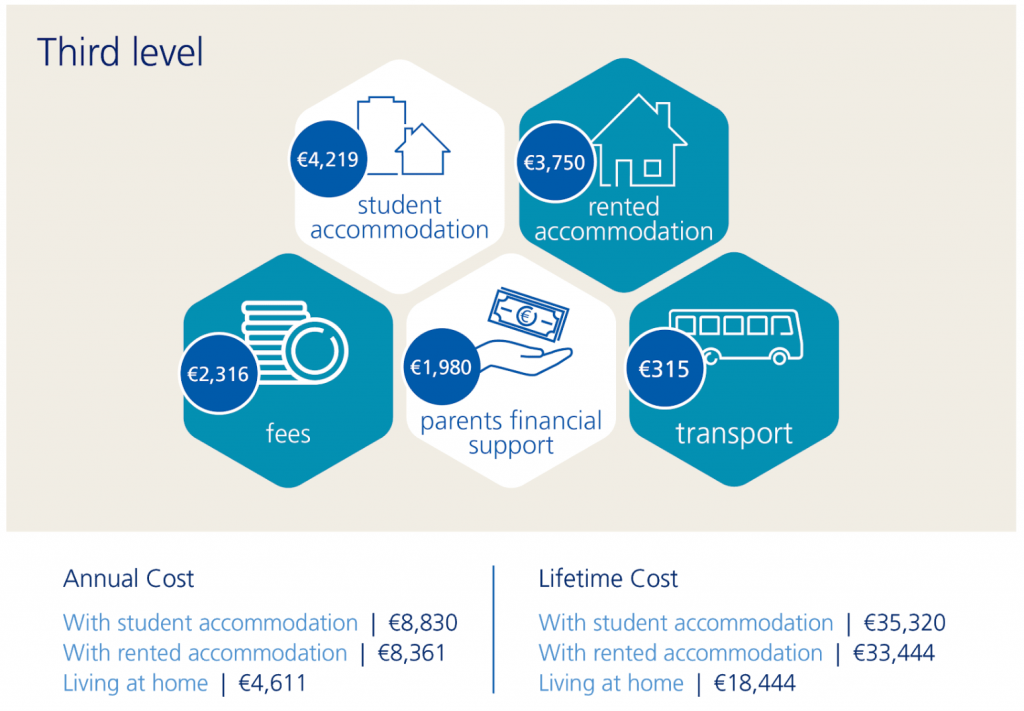

It’s clear to see that the cost of education is high and has continued to increase over the years. A Zurich Life survey in 2019 reveals the staggering costs for college students living at home and in rented or student accommodation.

While the average cost of sending a child to primary and secondary school might seem high, the expenses associated with third level education are in a completely different ballpark. All ‘free-fees’ third level institutions charge a mandatory student contribution. The maximum rate for 2019/20 is €3,000 per year. Unfortunately, this student contribution is just one of the costs likely to be incurred.

When it comes to third level, unsurprisingly accommodation represents a substantial average annual cost. In 2019, 51% of college students are living at home but the number of students living in rented accommodation has almost doubled to 29% compared to last year. The number of college goers living in student accommodation has also increased.

There is a dramatic increase in the average spend for student accommodation from €3,442 to €4,219 but the cost of rental during the academic year isn’t cheap either, averaging more than €3,750.

Another noticeable shift is in the mode of transport that third level students are using. Students have switched their main modes of transport to college from cars and cycling to using public transport and walking. It’s not surprising that students are trying to cut transport costs given that the average spend on transport to college has increased again this year from €303 to €315.

So how do you tackle this cost? One measure families are taking to help avoid putting their households under severe financial pressure, or pushing them into debt, is to ensure early planning around their children’s education, adopting measures such as early savings schemes.

The table* below illustrates just how much regular savings can grow with a standard savings plan. For example, if you saved the Government child benefit of €140 per month for five years (as of June 2019) from when your child was born, by the time they started school you could have built up savings of €8,613 in time to fund this crucial stage in their education.

This grows significantly if you have a lump sum to invest to kick start the fund. The growth is even more significant as your child gets closer to college years when it is most needed.

[table id=3 /]

Don’t leave it too late to plan…

The cost of educating your child can be expensive irrespective of where your child attends university. The problem is that many parents get to grips with the costs when it’s too late and end up having to fund everything out of day-to-day expenditure.

Remember, the mortgage and other utility bills you have today will still have to be paid when your child starts school. The only difference is you will be expected to manage those household costs on top of your child’s education. If you’re planning to support your children when they reach university, it might be wise to start saving now.

* A gross investment return of 3.9% per annum is assumed. On encashment, partial encashment, assignment, death or on each 8th anniversary of the policy, tax is deducted on gains made. The figures shown allow for the deduction of tax (currently 41%). Contribution increases of 2.5% per annum are assumed. An annual management charge of 1.25% and an allocation rate of 101% apply. A 1% government insurance levy applies on all contributions but may change in the future.

Adrian Godwin is a Senior Financial Consultant and the co-founder and managing director of Oaktree Financial Services. With a background in accounting and tax advising, Adrian specialises in estate planning and wealth management.Adrian offers clients reassurance through best practice solutions. His unique skill set and qualifications enable clients to develop comprehensive life plans that align with their goals.