Removal of Benefit-in-kind (BIK) for an Employee

A positive change has came into effect on 1st January 2023 for Employer contributions to PRSA’s. The Finance Act has now confirmed the removal of the Benefit-in-kind (BIK) charge on Employer contributions to a PRSA. This means that where contributions were previously treated as a BIK for the purposes of employee income tax, such contributions will now not attract a tax charge for an employee.

As of 1 January 2023, Employers will now be able to pay unlimited BIK free contributions to a PRSA for an employee or company director. The contributions will not be limited by salary and service, existing scheme funding or retained benefits.

How does this impact Employees?

The Financial Bill has now enacted this positive change for employees saving for retirement into a Personal Retirement Savings Account (PRSA). As an employee, you will now be given the same tax treatment as occupational pension scheme members in relation to any employer contributions to the scheme. This means that employer contributions will no longer be treated for tax relief purposes as an employee contribution.

Previously where an employer paid into the PRSA, that employer contribution used up part of the employees own scope within their age related limits to pension their income. This effectively restricted Employer PRSA contributions to levels that were significantly less than can be contributed BIK free to an Executive Pension or a Master Trust equivalent. This is no longer the case!

How does this impact Employers?

Employers will now be able to pay unlimited BIK free contributions to a PRSA for an employee or company director. The contributions will not be limited by the level of salary paid, service to date, existing scheme funding or retained benefits (pension benefits already accrued).

In other words, there is no longer any upper limit on an employer contribution to a PRSA and no requirement to spread forward tax relief as would be the case in Occupational Pension Schemes (OPS/Executive Pensions/OMA) when taking into account Ordinary Annual and Special Contributions.

An employer can only make a contribution to a PRSA for an Employee (that is, a registered employee who is receiving a salary under Schedule E with PAYE taxation applied at source).

PRSA Advantages for Company Directors

There are currently company directors who are already funding for their retirement using Executive Pension arrangements or One Member Arrangements (OMA) under a Master Trust. The funding rules within those schemes will allow more than enough scope for the contributions they wish to make for their retirement.

However, if you are a company director and are currently funding into an existing scheme, or have not set one up yet, the new update to the PRSA may be an even more attractive option, particularly if you are on a low salary with little or no scope to fund under an occupational pension scheme.

Since there is no maximum funding calculation to determine the ability of the Employer to contribute to a PRSA (as opposed to company pension schemes), if you are on a higher salary, you now have the option to extract a larger amount of profits and obtain tax relief in the current tax year immediately!

The only limit relates to the Lifetime Pension Fund Limit (Standard Fund Threshold, currently €2,000,000). These contributions will also be allowed as an expense in the year in which they are paid (with no upper limit). This differs to the Executive Pensions or OMA’s.

Potential Impact for 20% Directors of Investment Companies

A 20% director of a company that is treated for tax purposes as an investment company, currently is not accepted into membership of an occupational scheme or Executive Pension arrangements in relation to that employment. However, no restriction currently exists in respect of PRSA’s.

As a result, the current interpretation is that where a 20% director of an investment company is registered as an employee of that company and receiving a salary under Schedule E then the employer could make an employer contribution to a PRSA for the benefit of that director.

Simplifying Death Benefits

Another key advantage of the PRSA, which as a company director you may find attractive, is the more simplistic approach to a death benefit claim as PRSA funds can be paid in full to the estate of the deceased member in the event of death. Occupational pension schemes place restrictions on the maximum allowable lump sum payable with residual funds being used to provide a pension via an Annuity or to purchase an Approved Retirement Fund (ARF) for a spouse or dependents.

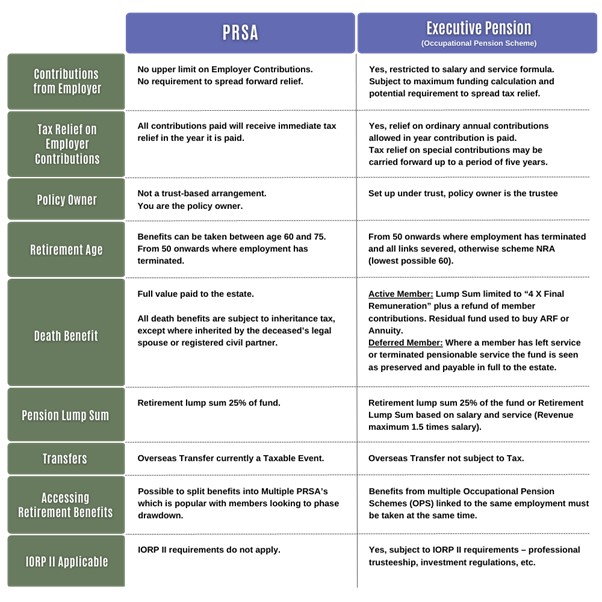

PRSA VS Executive Pension

As a Company Director or small employer, by comparing the below key differences, PRSAs may now offer you a more flexible and suitable means to retirement planning and saving according to your particular financial needs.

Summary of PRSA Opportunities

- Employer contributions to a PRSA no longer restricted.

- BIK charge on employer contributions removed. No longer included in age related limits.

- Tax relief on employer contributions can be claimed in the year its paid.

- Option for all PAYE employees.

- Employers don’t have to be a limited company – Sole trader and partnership.

- Not subject to IORP II investment rules, trusteeship.

- Member has more control.

- Lump sum from a foreign pension scheme forms part of life time allowance.

- Small employer – Group PRSA potential solution for less than 10 employees.

- Transitioning an Executive Pension to a Master Trust is not the only solution. PRSA is now a comparable alternative to the Executive Pension.

For more information about PRSA contributions, please contact us by calling 025-30588 or book a complimentary chat here.

Adrian Godwin is a Senior Financial Consultant and the co-founder and managing director of Oaktree Financial Services. With a background in accounting and tax advising, Adrian specialises in estate planning and wealth management.Adrian offers clients reassurance through best practice solutions. His unique skill set and qualifications enable clients to develop comprehensive life plans that align with their goals.