Saving for a Children’s Education is a topic that all parents should be well researched on. With what seems like never ending, rising, living costs it is more important than ever to set aside savings and plan for your child’s future education.

There has been some element of a reprieve with regard to the cost of third level education and some element of a credit with regard to rents being paid by students, it by no means has impacted the level of rent being paid by students – in cases where students can actually get a room! This blog will take into account of some of the recent changes.

No matter what stage of education your child is at, it’s a good idea to plan ahead for college fees as six in ten parents in Ireland expect to get into debt because of third level costs for their child.

We want to take some of the pressure off you while planning this next step in your child’s life, so we’ve broken down some of the costs and some tips to help you save for your children’s education.

Average costs of college in Ireland

College fees in Ireland have remained the same in Ireland at €3,000 since 2015, depending on which institution your child attends. Reductions can be achieved through the SUSI grant system based on household earnings. The average annual cost to send an Irish student to third-level education if living in rented accommodation in Dublin has now risen to almost €18,570, and over €12,000 if they are living in other parts of the country.

Most third-level courses are three to four years long, meaning you could be left with a jaw-clenching €74,280 bill! It’s important to keep inflation in mind too. Given that inflation is currently so high in Ireland, these costs may rise by the time your child heads off to college.

As we mentioned above there is likely to be amendments made to some of the grants to assist with the increases in the cost of education through the SUSI grant scheme, however that is assuming you qualify for the grant! While this is a good helping hand, but still only a small portion of the full amount needed.

Remember

When calculating third-level costs, you should include things like rent, food and transport costs not just books and tuition fees.

Tips to help you save for your child’s college education:

1. Create a habit

The best starting point is to get into the habit of saving by creating a savings plan. Try to put away a portion of your child benefit payments if you can, and if this isn’t feasible, aim to save a realistic percentage of your household budget each month.

2. Understand your spending

To help understand what you’re spending your money on, keep an eye on your bank and credit card statements. This will give you a realistic idea of what’s affordable savings-wise.

3. Evaluate your options

Once you’ve completed these first two steps, you’ll need to look at the most appropriate savings and investment options for you. This will depend on how long you have to save before your child starts college.

4. Find the right place

When deciding where to open your savings account, you’ll need to decide how much access to your money is required. Certain savings accounts require a set notice period before withdrawals can be made.

5. Help your savings work for you

Regular monthly saving aims to allow you to gradually build up the funds necessary to support your child’s third level education. You can save from as little as €100 a month through Regular Saver.

You also have the option of a single premium Investment Bond which gives your built-up lump sum the potential to grow over the medium to long-term. You can invest from as little as €20,000 through an Investment Bond.

Example

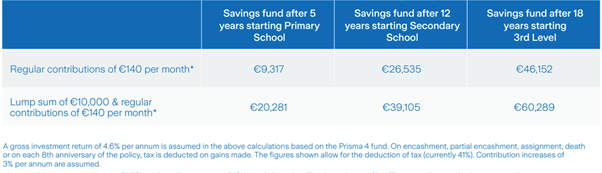

The table below illustrates just how much regular savings can grow with a Zurich Regular Savings plan. For example, if you saved the Government child benefit of €140 per month for 5 years (as of August 2023) from when your child was born, by the time they started school you could have built up savings of €9,317* in time to fund this crucial stage in their life.

With the above examples it needs to be borne in mind that past performance is not an indicator of future performance and that current market conditions may not achieve the returns anticipated in the examples. On that basis, the sooner you start to plan for these costs and put into action that plan the more likely it is that you will achieve your goal.

If you would like to discuss this topic further and put in place a plan for your child’s education then please call us on 025-30588 or book a complimentary chat here. We are always happy to help whether it is in our office, via zoom or over the phone. You can also click here to use our cost of education calculator.

Adrian Godwin is a Senior Financial Consultant and the co-founder and managing director of Oaktree Financial Services. With a background in accounting and tax advising, Adrian specialises in estate planning and wealth management.Adrian offers clients reassurance through best practice solutions. His unique skill set and qualifications enable clients to develop comprehensive life plans that align with their goals.